Trade (1.1) #

International demand #

In MIRAGE-e, final demand, intermedate demand and capital good demand for good $i$ are aggregated to form total demand $DEMTOT_{i,s,t}$:

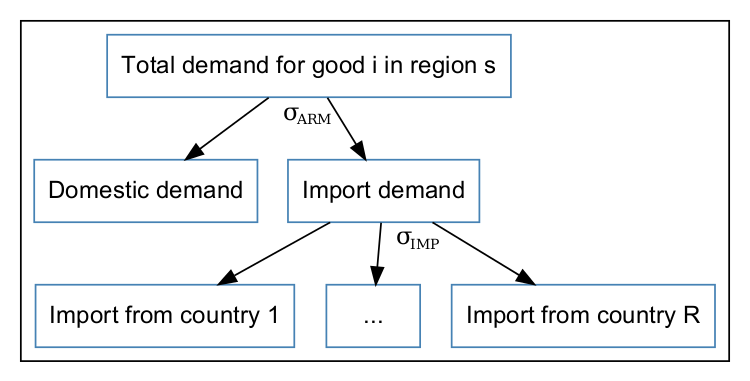

(Standard) Armington assumption #

By default, the regional demand in MIRAGE-e uses a standard Armington-type specification using CES functions, with a home bias: it is easier to switch between imports of different origins than between domestic production and imports.

The value of elasticity $\sigma_{IMP}$ is sourced from the GTAP database, while other elasticities will follow the $\sqrt{2}$ rule:

Imperfect competition #

When the sector is configured as imperfectly competitive, the demand for good $i$ from $r$ to $s$ is a CES aggregate of each variety, with an elasticity following the $\sqrt{2}$ rule.

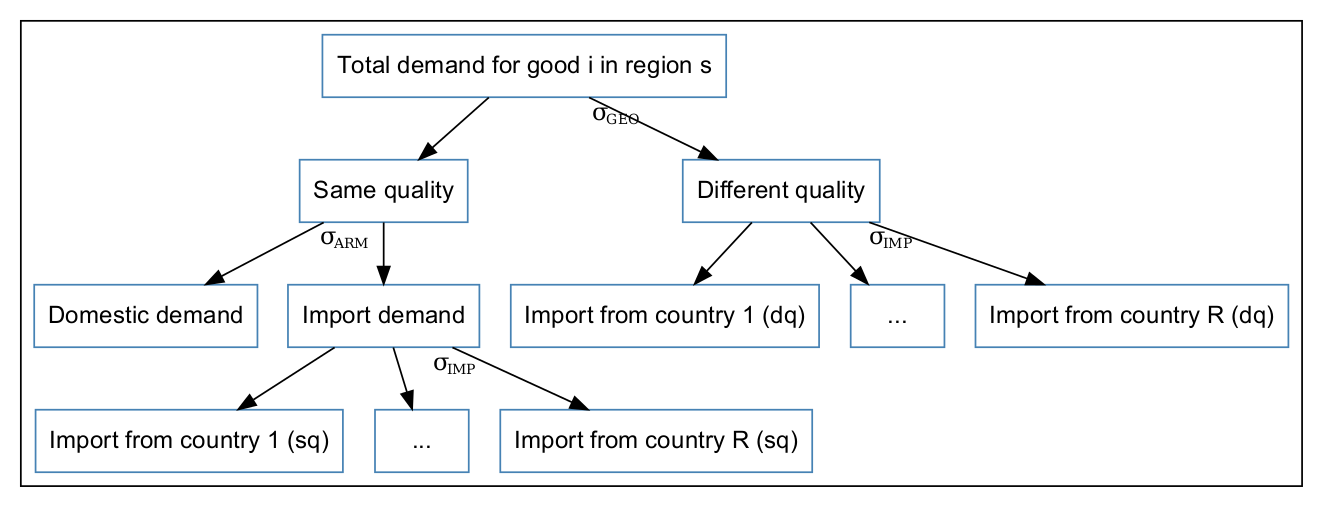

(Optional) Quality differentiation #

Importance in trade of vertical differentiation and specialisation across quality ranges has been widely illustrated (see e.g. [(:harvard:Font97)], [(:harvard:Gree00)]). Even though it is not easy to model nor quantify, this is an important device as far as analysing the nature and intensity of competition is concerned.

This is why a further CES nesting level can be added to the subutility function for some sectors of the aggregation, distinguishing between two quality ranges, defined on a geographical basis: goods produced in a developing economy are assumed to belong to a different quality range than those produced in a developed economy (the demand nesting is displayed in the figure below). The choice of substitution elasticities (the one between qualities is inferior to the Armington elasticity) implies that goods that do not belong to the same quality range are less substitutable than goods from the same quality range. This means for instance that, within a given sector, goods from a developing country compete more directly with goods from any other developing country, than with goods from any developed country.

Trade costs #

Trade costs are of two different types in MIRAGE-e:

- Purchasing of international transportation services

- Non-tariff measures

International transportation services #

See The Transport Sector.

Non-tariff measures #

Data #

MIRAGE-e only uses information on the trade-restrictiveness of NTMs (no benefit is considered), using ad-valorem equivalents from:

- [(:harvard:Font2016)] in Services sectors

- [(:harvard:Kee2009)] in Goods.

Modelling #

Non-tariff measures (NTMs) can either be modelled as:

- an iceberg trade cost

- an export-tax equivalent (rent-generating)

- an import-tax equivalent (rent-generating)

- any split between the three alternatives

By default, in absence of specific knowledge about the best modelling assumptions, NTMs are assumed to be 1/3 iceberg, 1/3 export-tax equivalent, 1/3 import-tax equivalent.

In every region, the rents created by import-tax equivalent NTMs on imports and export-tax equivalents on exports are allocated to the representative household by a lump-sum transfer.

Implementation through “generalized” costs #

From MIRAGE-e version 1.1, trade costs are separated from standard costs, through the use of endogenous “generalized” tariffs ($GnTariff_{i,r,s,t}$), export taxes ($GnTaxEXP_{i,r,s,t}$) and iceberg trade costs ($GnTC_{i,r,s,t}$):

- $ GnTC_{i,r,s,t} = 1 + tCost_{i,r,s,t} + shareNTM^{tCost}{i,r,s}\left(tax^{SER}{i,r,s,t} + NTM_{i,r,s,t}\right) $

- $ GnTariff_{i,r,s,t} = Tariff_{i,r,s,t} + shareNTM^{Tariff}{i,r,s} NTM{i,r,s,t} $

- $ GnTaxEXP_{i,r,s,t} = tax^{EXP}{i,r,s,t} + tax^{MFA}{i,r,s,t} + shareNTM^{taxEXP}{i,r,s} NTM{i,r,s,t}$

Any trade policy scenario has therefore to be implemented directly on $Tariff_{i,r,s,t}$, $tCost_{i,r,s,t}$, $NTM_{i,r,s,t}$, $tax_{i,r,s,t}^{SER}$ and $tax_{i,r,s,t}^{EXP}$