MIRAGE-e Baseline

For MIRAGE-e and the versions that follow it, the dynamic baseline follows the macroeconomic projections of MaGE model. The following variables are used from MaGE’s output, the EconMap database:

- GDP projections

- Population

- Skilled and unskilled labor

- Savings rate and current account

- Energy productivity

In addition to these variables from MaGE/EconMap, the following assumptions are also included in the baseline:

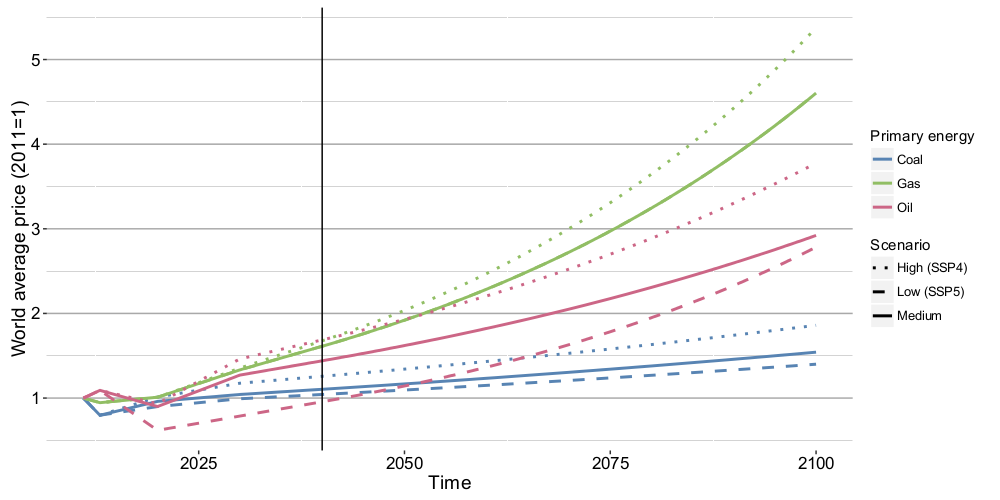

- Fossil energy prices trajectories are calibrated after International Energy Agency projections

- Sector decomposition of TFP growth between agriculture, manufacturing, and services

General presentation of the baseline design

By default, the baseline exercise is made of two sets of model simulations:

- Only projections in macroeconomic determinants. It is also possible to include in this step other assumptions, but this requires that such assumptions are not likely to impact GDP growth significantly.

- This is the “baseline” strico-sensu, as it is common in most CGE models

- In this step, the GDP trajectory is imposed on the model in order to calibrate the trajectory of TFP growth

- Other assumptions are implemented in the second step (e.g. large free trade agreements, Paris Agreement)

- This step takes the productivity calibrated in step 1 as given, and let GDP be endogenous.

- This allows us to account for the effect of baseline assumptions on GDP and energy prices

GDP projections

TFP in MIRAGE-e

TFP in MIRAGE-e consists in a region-specific TFP, \(TFP_{r,t}\) and a sector-specific component \(TFPJ_{j,r,t}\). Both concern only energy and the five factors (capital, skilled labor, unskilled labor - embodied in the \(VAQL_{j,r,t}\) bundle - as well as land and natural resources) of the production function: \[ \begin{array}{rl} VAQL_{j,r,t} &= a^{VAQL}_{j,r} VA_{j,r,t} \left(TFP_{r,t}TFPJ_{j,r,t}\right)^{\sigma_{VAQL}-1} \left(\frac{P^{VA}_{j,r,t}}{P^{VAQL}_{j,r,t}}\right)^{\sigma_{VAQL}}\\\\\\ Land_{j,r,t} &= a^{Land}_{j,r} VA_{j,r,t} \left(TFP_{r,t}TFPJ_{j,r,t}\right)^{\sigma_{VAQL}-1} \left(\frac{P^{VA}_{j,r,t}}{P^{Land}_{j,r,t}}\right)^{\sigma_{VAQL}}\\\\\\ NatRes_{j,r,t}RESV_{j,t} &= a^{NatRes}_{j,r} VA_{j,r,t} \left(TFP_{r,t}TFPJ_{j,r,t}\right)^{\sigma_{VAQL}-1} \left(\frac{P^{VA}_{j,r,t}}{P^{NatRes}_{j,r,t}}\right)^{\sigma_{VAQL}} \end{array} \]

Calibration in the baseline exercise

MIRAGE-e baseline (in Step 1) exercise starts from the following assumptions in order to calibrate a baseline trajectory for TFP:

- MaGE GDP growth rates: \(g^{GDP}_{r,t}\)

- Exogenous agricultural TFP: \(TFP^{Agri}_{j,r,t}\)

- Constant 2 p.p. growth difference between manufacturing and services: \(\Delta g^{TFP}_j\)

This translates into the following relations: \[ \begin{array}{rll} GDP_{r,t} &= \left(1+g^{GDP}_{r,t}\right) GDP_{r,t-1} &\\ TFP_{r,t}TFPJ_{j,r,t} &= TFP^{Agri}_{j,r,t} &\text{if}\quad j\in Agri\\ TFP_{r,t}TFPJ_{j,r,t} &= \left(1+\Delta g^{TFP}_j\right) TFP_{j,r,t} TFPJ_{j,r,t-1} &\text{if}\quad j\notin Agri \end{array} \]

Population and labor

Population and labor by educational level simply follow the growth rate from EconMap: \[ \begin{array}{rl} Pop\_ag_{r,t} &= ActivePopulation_{r,t}\\ TotalUnSkL_{r,t} &= TotalUnSkL_{r,t-1} \left(1+g^{UnSkL}_{r,t}\right)\\ TotalSkL_{r,t} &= TotalSkL_{r,t-1} \left(1+g^{SkL}_{r,t}\right) \end{array} \]

Savings rate and current account

Current account in MIRAGE-e

Current account (im)balances \(CABal_{s,t}\) are used in the macroeconomic closure equation:

\[ Sav_{s,t} REV_{s,t} = P^{INVTOT}_{s,t} INVTOT_{s,t} + CABal_{s,t} WGDPVal_t \]

Calibration of savings rate and current account

Savings rate

Savings rate follows EconMap projections \(Savings_{r,t}\) additively: \[ Sav_{r,t} = Sav_{r,t-1} + \left(Savings_{r,t}-Savings_{r,t-1}\right)\]

Current account

Current account imbalances evolve additively: \[ CABal_{r,t} = CABal_{r,t-1} + \delta CABal_{r,t}\]

while \(\delta CABal_{r,t}\) is calibrated after EconMap’s \(CurrentAccount_{r,t}\), but keeping world current account balance: \[ \begin{array}{lr} \delta CABal^0_{r,t} = CurrentAccount_{r,t} \frac{GDP[{r,t}}{\sum_s GDP_{s,t}} - CurrentAccount_{r,t-1} \frac{GDP[{r,t-1}}{\sum_s GDP_{s,t-1}}\\\\\\ \delta CABal_{r,t} = \delta CABal^0_{r,t} - \left(\sum_s \delta CABal^0_{s,t}\right) \frac{GDP[{r,t}}{\sum_s GDP_{s,t}} \end{array} \]

Energy productivity

This feature is only available if energy in value added is toggled on.

Energy productivity in MIRAGE-e

In MIRAGE-e, total energy consumption by each sector \(ETOT_{j,r,t}\) is subject to energy-specific technological improvement \(EE_{j,r,t}\): \[ETOT_{j,r,t} = a^E_{j,r,t} EE_{j,r,t} KE_{j,r,t} \left(\frac{PKE_{j,r,t}}{PE_{j,r,t}}\right)^{\sigma_{KE}}\]

\(EE_{j,r,t}\) is applied to every sector except for non-electricity energy-producing sectors (coal, oil, gas, petroleum, and coal products), whose energy productivity is constant.

Baseline calibration

This energy-specific technological improvement is calibrated in the baseline after MaGE’s projected energy productivity \(B_{r,t}\). However, three things differ between \(B_{r,t}\) and \(EE_{j,r,t}\):

- In MIRAGE notations, share coefficients and productivity improvement appear in CES functions at the power of \(1/\sigma\) whereas in MaGE, \(B_{r,t}\) appears at the power of \((\sigma-1)/\sigma\). We therefore introduce \(EProd_{r,t}\): \[EProd_{r,t} \equiv B_{r,t}^{\sigma_{KE}-1}\]

- \(B_{r,t}\) is labeled in dollars per ton of oil equivalent, whereas \(EE_{j,r,t}\) and \(EProd_{r,t}\) are calibrated at 1 \[EProd_{j,r,t} = EProd_{j,r,t-1} \left(1+g^B_{r,t}\right)^{\sigma_{KE}-1}\]

- In MaGE’s production function, \(B_{r,t}\) (as well as capital-labor productivity \(A_{r,t}\)) include a hypothetical TFP, whereas in MIRAGE, \(EE_{j,r,t}\) comes in addition to the TFP level \(TFP_{r,t}TFPJ_{j,r,t}\) \[EE_{j,r,t} = \left(\frac{EProd_{r,t}}{TFP_{r,t}TFPJ_{j,r,t}}\right)^{\sigma_{KE}-1}\]

Fossil fuels energy prices

Natural resources in MIRAGE-e

In MIRAGE-e, a sector-specific reserve factor \(RESV_{j,t}\) is introduced to scale natural resources globally for each primary fossil energy, coal, oil gas (the equation is provided here for perfect competition only): \[NatRes_{i,r,t} RESV_{i,t} = a^{NatRes}_{i,r} Y_{i,r,t} \left(\frac{P^Y_{r,t}}{P^{NatRes}_{r,t}}\right)^{\sigma^{NatRes}}\]

Calibration of natural resources in the baseline

During the baseline exercise, the reserve factor is set endogenous, while world price is defined as: \[ \log \left(PWORLD_{i,t}PWO_i\right) = \frac{\sum_{r,s} TRADE_{i,r,s,t} \log PCIF_{i,r,s,t}}{\sum_{r,s} TRADE_{i,r,s,t}} \] is kept exogenous: \[ PWORLD_{i,t} = PWORLD_{i,t-1}\left(1+g^{P}_{i,t}\right).\]